1. Start With a Conversation, Not a Quote

Sure, it’s easy to get a quick quote online. But real protection starts with the right questions:

- What would be financially devastating if it happened?

- What have you worked hard to build?

- How has your life changed in the last year?

A good insurance plan doesn’t begin with numbers. It starts with

understanding you. That’s why at The Ryan Agencies, we never just drop coverage into a template. We listen, we ask, and we build from there.

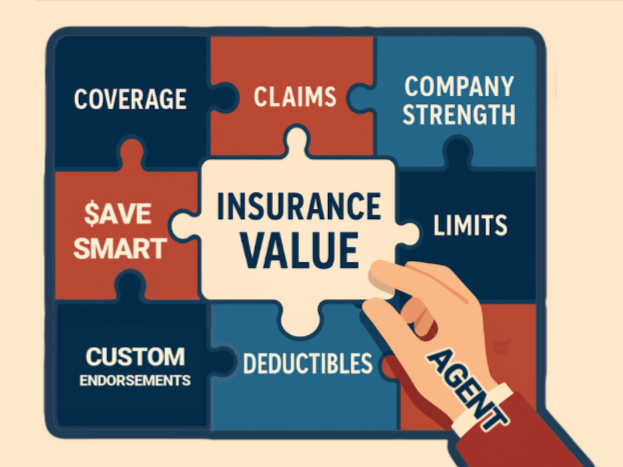

2. Transfer the Big Risks, Keep the Small Ones

Insurance exists to

transfer risk, but smart planning also involves knowing which risks to retain.

That often means:

- Choosing the highest deductible you can comfortably afford, so you’re not paying extra to cover small, manageable losses

- Raising your liability and property limits to prepare for the risks that could seriously disrupt your finances or future

- Using Savesmart strategies like bundling and credit awareness to save efficiently, without weakening protection

Insurance should be there for life’s big financial hits. Not the ones you could cover with a rainy-day fund.

3. Customize Where It Counts

No two policies should look exactly alike, because no two lives or households do. The right plan includes add-ons and endorsements that fit your real risks.

For example:

- Auto: Rental reimbursement, roadside assistance, vanishing deductibles, OEM parts

- Home: Water backup, scheduled valuables, extended replacement cost

- Business: Cyber liability, loss of income, employee dishonesty

- Umbrella: Extra liability coverage across all policies

These aren’t bells and whistles. They’re what protect you from the kind of loss that sets you back for years.

4. Choose a Carrier That’s Ready to Show Up

We covered this in Part 5, but it bears repeating: your policy is only as strong as the company backing it.

That’s why we help you:

- Look beyond the price to understand

claims performance and customer reviews

- Check

AM Best ratings and financial strength

- Choose a company that aligns with your priorities, not just one that shouts the loudest on TV

When things go sideways, you want to know your company is steady, fair, and responsive. Not learning about that the hard way.

5. Don’t Forget the Human Side

An insurance plan isn’t just about documents and limits. It’s also about

people.

The people who help you build it, update it, and stand by you when you need it.

When your life changes… new car, renovation, side hustle, teenage driver—you deserve someone who:

- Picks up the phone

- Knows your history

- Checks the details

- Advocates for you if a claim gets tricky

With an independent agent, you don’t start from scratch every year. You build a relationship. That’s part of the value.

A Real-World Snapshot: Building a Plan That Works

A client came to us with a significant life transition: a marriage, a new home, and a growing business on the side.

Instead of piecing policies together, we took a strategic approach:

- Upgraded liability coverage to match new responsibilities

- Added an umbrella policy for broad protection

- Scheduled wedding rings and a family heirloom

- Updated their home coverage to reflect the actual rebuild cost

- Choose a higher deductible to help offset premium costs

The result? Better protection, a more efficient plan, and meaningful long-term savings.

That’s a textbook

Savesmart move: efficient, protective, and aligned with their goals.

Final Thought: Build a Plan, Not Just a Policy

You don’t need to be an insurance expert to be protected. You just need someone who asks the right questions, listens closely, and helps shape your coverage with intention.

Because the value of your insurance isn’t just in what it costs. It’s in what it protects, and how it holds up when life doesn’t go as planned.

That’s the kind of

Insurance Protection You Can Rely On.

Let’s build a plan that fits you, not just the price tag.

Together, let’s build value…

Call, visit, or see RyanAgency.com for Insurance Protection You Can Rely On.