-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

Gap insurance is recommended more frequently because lenders are now willing to finance a greater percentage of the vehicle over a greater span of time.

There was once a time when lenders would expect a reasonable down payment (10–20%) and limit the auto loan terms to 3–4 years. Fast forward to now when banks are willing to finance 100%+ of the vehicle's value over as many as seven (7) years.

With depreciation, that can result in a borrower (owner) of a car to owe more than the value of the car for nearly the whole term of the loan.

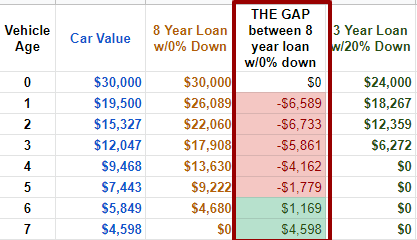

Below is an amortization schedule and graph to illustrate how a “Gap” is created when a $30,000 vehicle is financed over an 8-year loan with 0% down versus a 4-year loan with 20% down. Both loans assume a 3% interest rate.

In this illustration, we used a higher than average depreciation to better demonstrate the vehicle’s value is less than the amount owed from day one until year six.

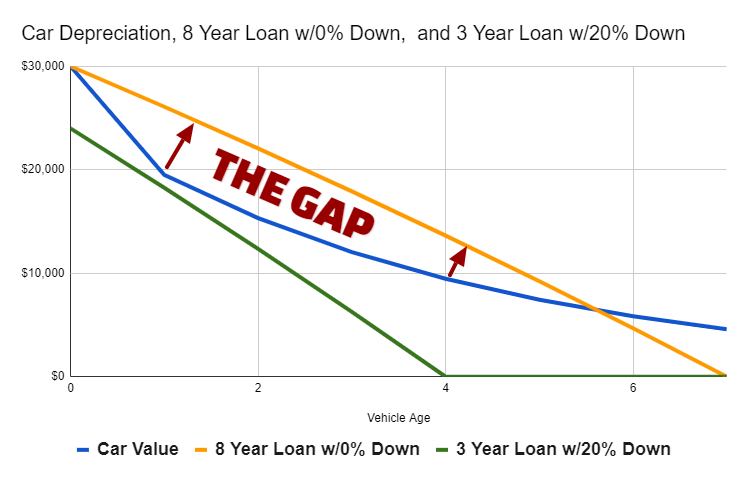

Illustrated in graph form, “The Gap” looks like this:

“Why is gap insurance recommended now when it was not needed before with regular car insurance?”

If totaled, an unendorsed car insurance policy pays for the vehicle's current value, not the amount one might owe on a loan.

Many borrowers are upside down or simply owe the bank more than the car is worth in today's lending environment.

Gap insurance is designed to make up that difference.

Important Note: Some insurance companies do NOT provide the opportunity to add “Gap” coverage. Call our office and we will be glad to review with you those carriers who offer this valuable protection.

Have additional car insurance questions? We LOVE to help! Please feel welcome to call us at 607-324-7500.

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244