-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

By now you’ve likely realized that the cost of everything is going up! U.S. supply chain problems and computer chip shortages put pressure on the availability and pricing of vehicles and housing materials.

The overall inflation rate reported by the US Labor Department only shows an annualized rate of change at 5.4%. However, other essential segments have seen much higher rates of increase, including new vehicles and building material costs.

Car Prices and Costs:

Supply chains and a Computer Chip Shortage for vehicles have resulted in a lack of new cars and catapulted the value of used cars by 20 to 30% year over year ! Prices have skyrocketed.

Drive by your favorite car dealership, and you’ll also see that inventory levels are at an all-time low.

Impact on Your Car Insurance:

The good news is that your car insurance policy must respond to the changes in the value of new and used vehicles. Another important note is that Comprehensive and Collision coverages typically do not come with a stated maximum limit.

Most auto policies pay for the

Actual Cash Value of vehicles

. So as vehicle values change -- in this case, going UP , so does the payout in the event you have a claim. In other words, auto comprehensive and collision settlements will reflect the increased costs.

Home Building Materials Prices:

As of September 2021,

the Producer Price Index for construction materials is up 23% over the last 18 months.

The cost to rebuild a home has seen significant cost pressure.

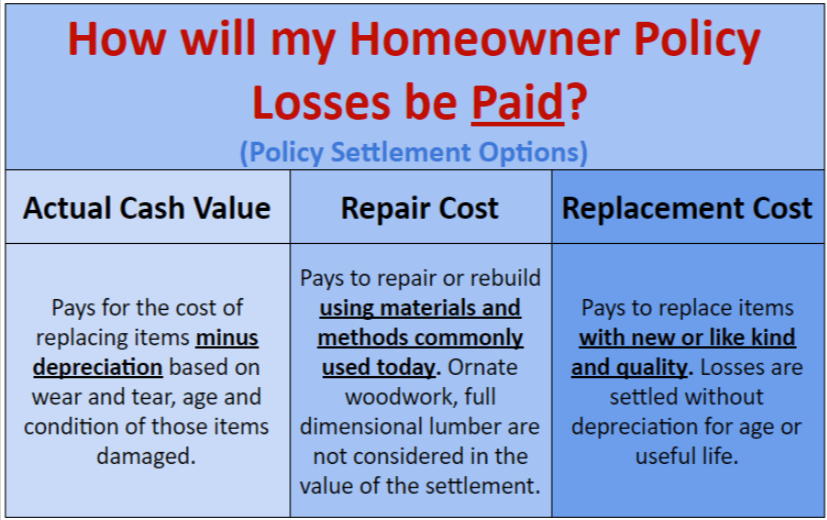

However, many homeowners’ policies (especially in our rural area) are not written with Replacement Cost Settlement provisions. Alternative loss settlement options are popular and may be based on Actual Cash Value (replacement cost minus depreciation) or Repair Cost (cost reflecting commonly used building materials).

The chart below outlines some of the different Loss Settlement Options available on homeowners insurance policies in New York:

With all the economic changes in the last year, we wanted to invite you to review your policies. Give us a call to review and discuss your homeowners’ insurance program. There may not have EVER been a better time to do that … than right now.

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244