-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

The short answer is a “ qualified yes”.

An extension of coverage for what is typically called a “newly acquired auto” is either provided (or not) based on your auto insurance contract’s terms.

Many policies utilize an ISO Personal Auto Policy form (IE: PP 00 01 01 05) or mimic verbiage similar to that outlined by that contract.

Below are some snippets from an ISO Personal Auto Policy pertinent to this question.

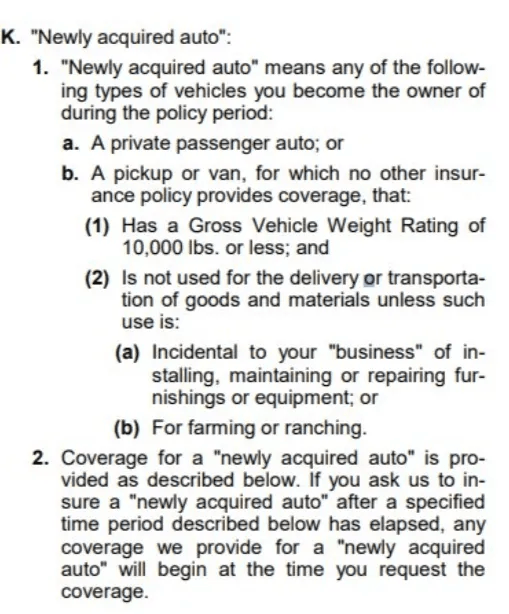

This first one defines what a “Newly acquired auto” is:

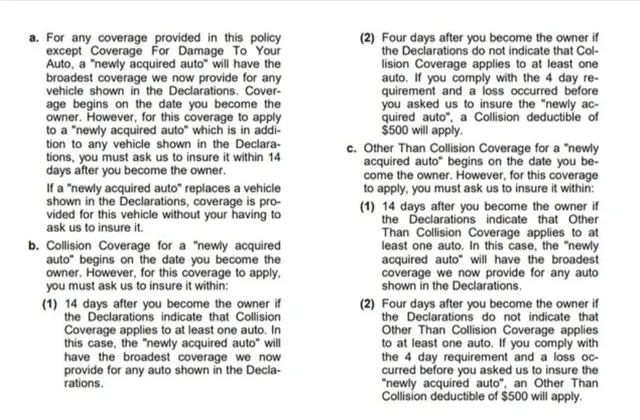

The ISO Personal Auto Policy form (PP 00 01 01 05) goes on to describe the circumstances where different coverage parts apply:

Many policies will extend at least some coverage parts (IE: Liability) benefits for up to 30 days.

As the form above suggests, Comprehensive and Collision may only be extended for four (4) days if no other vehicle on the policy includes those coverage parts.

It may also be worthwhile to note that none of the policy language above speaks to state registration requirements for coverage to be triggered. That is a separate transaction.

Does that mean you shouldn’t call your agent to notify them as soon as possible after purchasing an auto? Of course not. Contacting your agency or company should happen at the earliest opportunity and include a discussion about the specific coverage you want on your new car.

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance related question to “Ask Jeff”.

-------------------------------

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244