-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance related question to “Ask Jeff”.

-------------------------------

555-555-5555

mymail@mailservice.com

contact us today

What are the consequences of a rental car that is in an accident while driven by someone that is insured, but not an authorized driver on the rental contract?

It’s quite simple: The rental car contract, and insurance coverages provided by that contract may be VOIDED.

What then, are the consequences of a voided rental contract? Benefits that are normally extended or even purchased with the rental car contract can be terminated. It also creates the potential for the unauthorized driver’s insurance policy to deny physical damage coverage for the rented vehicle.

Rental Car Contract:

The rental car contract is between the person(s) signing the contract and the rental car company. It should come as no surprise, that the contract may be breached if the contract signer allows the use of the rental vehicle, counter to the contract provisions.

The terms “authorized” or “unauthorized” driver are liberally used in any rental car agreement.

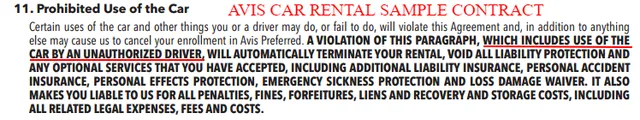

As an example, the Avis Rental Car Contract

shown below, is clear that an unauthorized driver terminates the contract.

If so, what are the consequences?:

According to the Avis contract, the consequences include:

This type of contractual intent or clause is not unique to Avis.

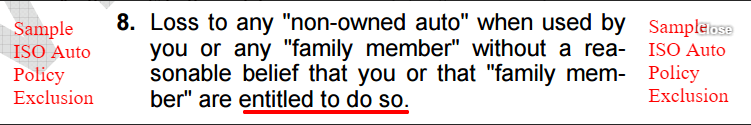

If another driver has insurance, one should not assume that their insurance will extend to the rental car that you are renting. The sample ISO Personal Auto policy extends to rental cars specifically if the vehicle in question is a “non-owned auto” of the insured. Sample ISO Auto policy exclusion language can be seen below:

If the driver is otherwise insured and the rental vehicle is being used without contractual entitlement, there may be conflicts regarding which policy (if any) is going to respond.

How the company will respond in this instance will depend on the state in which the accident occurred, the state in which personal auto policy was written, the insurance company, and their specific contract wording.

When renting a car, it is always in the renter's best interest to make sure that all drivers are “authorized” by the rental car company and also otherwise insured.

Have additional insurance questions? We LOVE to help. Please feel welcome to call us at 607-324-7500

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance related question to “Ask Jeff”.

-------------------------------

This article was originally published at Quora.com.

To see Jeff's Quora.com profile click here.

-------------------------------

“Ask Jeff" is a weekly post made on the RyanAgency.com Blog.

Submit an insurance-related question to “Ask Jeff”.

-------------------------------

This article may have been originally published at Quora.com.

To see Jeff's Quora.com profile click here.

Service@RyanAgency.com

Hornell: 607-324-7500

Jasper: 607-792-3800

Wellsville: 585-593-4244